If you invest like me, more than likely you have some or most of your invested funds in the stock market. With some economists calling the last decade the "lost decade" due to pretty much stagnate market growth, it's understandable why so many people are seeking out conservative and safe investments. I can only imagine the folks who's retirement was was strong and in the market back in 2008 only to see half of their funds get completely demolished. It's enough to run chills down your spine.

Due to this once in a lifetime market crash, people started fleeing the market and instead turned to safer investments such as CD's, money market funds, and savings accounts. The Federal Reserve in their attempt to stimulate the economy is on its way to complete the third round of quantitative easing (a.k.a printing money). This has essentially caused interest rates to fall through the floor, yet many people aren't investing in the market. What the heck is going on?

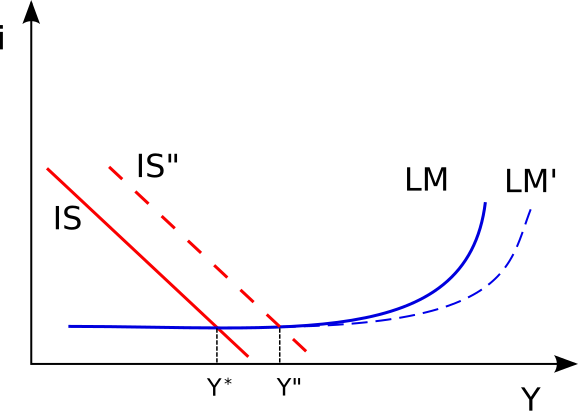

Welcome the liquidity trap!!!

|

| A representation of the liquidity trap |

The above diagram essentially shows us the when we move from LM (liquidity of money) to LM', personal investment in savings increases and interest rates stay the same with little growth. The problem is that we lost some of spending craze.

Wait a second here, I know what you're thinking. I've been proclaiming the great word of saving to get your financial house in order, so what's wrong with this scenario. The problem is that people are investing in the wrong kind of savings. If you're not getting a return on your investment at least as large as the current inflation rate, then you are essentially loosing money. As of writing this post, annualized inflation is hovering around 1.69%, so if you're not making at least 1.69% after taxes and fees, you my friend are losing money.

So what are we to do? Well, what did Columbus do? He ignored the critics and nay-sayers and sought out adventure. Now, what he did was a little crazy and if it wasn't for the new world being in the way towards India, then Columbus and is men would have starved to depth, but I digress.

Instead of putting your money in a CD or Savings account, why not try an index fund. I know there's risk, but life is risky and you won't get anywhere without taking chances.

Wonderful Moment of the Day: Bought 3 bags of cow manure for next year's garden!

No comments:

Post a Comment